Avocado seasonality in the US and other neighboring markets.

Avocados are currently the most consumed tropical fruit in the world. Among the countries globally, the US market is the most attractive in terms of consumption and prices, making it the preferred target market among the countries with the largest avocado production.

For this reason, understanding the behavior and avocado seasonality of producers are necessary to identify the opportunities that exist. By being aware of the fluctuations in availability and pricing during different periods of the year, producers can maximize their profits while buyers can adjust their purchasing strategies accordingly.

US Avocado Production and Imports

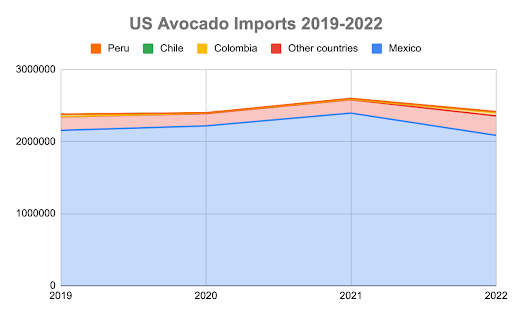

Currently, US avocado imports considerably exceed domestic production, given that in 2022 these were 2.5 billion and 7.9 million pounds, respectively.

In addition, domestic production occurs mostly in California and with smaller contributions from Florida and Hawaii. In terms of avocado seasonality, volumes in these regions are produced between April and September, with the highest flow in the months of May, June, and July. This means that from October to March, there is little or no volume, requiring imports to meet the demand throughout the year.

However, something that stands out is that when domestic production is available, imports do not decrease, which indicates that there is room in the market for both activities, and there is even some talk about US consumers being able to absorb higher avocado volumes, at least until 2030, considering the growth trend of recent years.

Avocado Seasonality of the Main Exporting Countries

Mexico has the enormous advantage of its geographical location, which has allowed it to consolidate as the main avocado supplier for the US market. However, what triggered its consolidation was the gradual permission to export granted in 1997, after 83 years of a ban that aimed to protect local production. Nevertheless, as this is focused on summer, and given that consumption began to increase significantly, imports became more and more necessary.

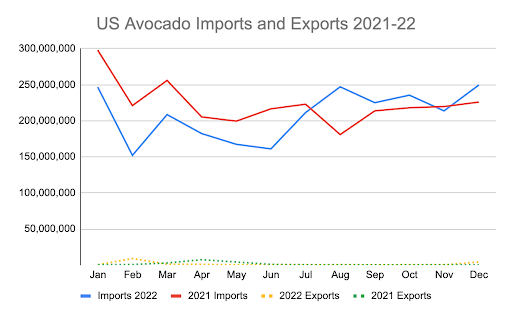

Since then, Mexico has consolidated its position as the world’s largest avocado exporter. Recently, the US represented the market that took 88.1% of Mexico’s total exports. Furthermore, Mexico’s avocado seasonality takes place throughout the year, with the highest volumes at the beginning of the year and the lowest volumes at the end of the summer.

The avocado seasonality of Peru, the second largest US avocado supplier, allows it to send volumes between May and November, with the highest volumes in July and August, while the Dominican Republic makes smaller shipments throughout the year without a major peak.

In the case of Chile, which until 2007 was the main exporter to the US, now only makes minimal shipments, partially because its production is facing water shortage problems and because it also exports to European countries. But despite being only the fifth largest avocado importer to the US, Chile is strengthening its position in this market. In 2022, Chile’s US avocado import volumes almost doubled to 16,414 pounds, compared with 2021 US imports.

Customers of the Main Avocado Exporters

In the case of Mexico, avocado exports are to the US, with Canada and Japan as the next destinations.

Diversification is precisely Peru’s main competitive advantage, it is now the main supplier of avocado in the EU, covering 35% of avocado imports in the region. In 2023, Peru plans to tweak its strategy by improving the spread of avocado exports to other countries, which means reducing shipments to Europe and increasing avocado imports to the US and Asia.

Now, Chile, aside from its shipments to the US, sends avocados to European markets, such as the Netherlands and the UK.

The US is the most important market for avocados, and Mexico is currently the absolute leader. While countries such as Peru and Chile have diversified their avocado exports, these countries continue to put importance on US avocado demand.

In the case of US avocado production, domestic production is mainly for domestic consumption, although 30.3% of its avocados are exported to South Korea, while Canada and Japan receive 19.2% and 16.8%, respectively, of US avocado exports.

ProducePay’s Role in the Agricultural Sector

At ProducePay, we aim to provide a better produce trade for all stakeholders in the industry. ProducePay Marketplace is an online trading platform that allows growers and buyers to find each other to fulfill their selling and buying needs. Other Marketplace solutions include:

- Market insights, such as updated reports on price, movement, and more.

- Financing solutions that ensure easy and secure access to cash flow and ensure quick payouts.

- Sustainability programs to assist with meeting their ESG goals.

- Supply chain services that link sellers with pre-vetted third-party logistics partners to ensure a trusted delivery process.

During 2022 alone, we reached more than 700 customers in 10 countries and had nearly $4 billion in transactions through our online marketplace. Contact us to learn more about how ProducePay can help you improve your fresh produce business.

Sources:

- EuroFresh Distribution. Europe’s avocado consumption rises 7%

- Fresh Fruit Portal. Peru is now the leading supplier of avocados and blueberries in the EU.

- Fruitnet. Peru poised for big rise in avocado shipments.

- USDA-ERS. Fruit and Tree Nuts Data – Data by Commodity – Avocado