An overview of the Mexican avocado season: production and export volumes.

Mexico is a huge contributor of avocado volumes in the world. Mexican avocado season lasts almost all year long, thanks to the country’s climate and fertile soils that make it a very suitable environment for avocados to grow.

This meets the requirements of consumers and helps keep prices competitive in the world market. Mexico’s production capacity also helps ensure that there is always adequate supply, even during peak demand periods.

According to the most recent data from FAOSTAT, global avocado production increased to nearly 8.7 million tonnes in 2021 from 8.1 million tonnes in 2020. Mexico was the main producer, at 2.4 million tons. This plays a large factor as to why Mexico is a huge contributor to world avocado exports. Let’s take a closer look at the Mexican avocado season and how it translates to production and export volumes.

Mexican Avocado Production

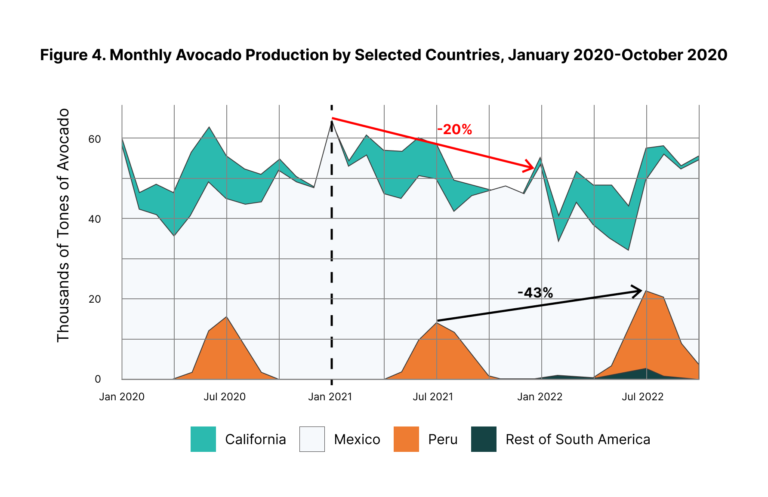

In Mexico, avocado-cultivating regions can produce practically throughout the whole year. The highest volume is produced between September and December, and the lowest is between April and June.

The Mexican avocado season has four blooming phases (loca, aventajada, normal, and marceña), allowing continuous bloom from August to March. Since each bloom produces fruits of different quality, and because quality can vary within each bloom, they must be separated during harvest and packing.

The “loca,” or crazy bloom, occurs when rains are delayed — a shortage of water causes a slower ripening process because there is not enough dry matter for the fruit to ripen properly. In this bloom, the fruit contains more water than oil. Normally, a higher oil-to-water ratio is an indicator of higher quality.

Generally, the “loca” Mexican avocado season occurs in August and September, the “aventajada” (or advantaged) bloom occurs between October and December, the normal bloom occurs between December and February, and the “marceña” bloom occurs in February and March. These approximate bloom periods are for Michoacán, the main national producer. In other states, these periods can vary.

Source: FarmDocDaily

Mexican Avocado Exports

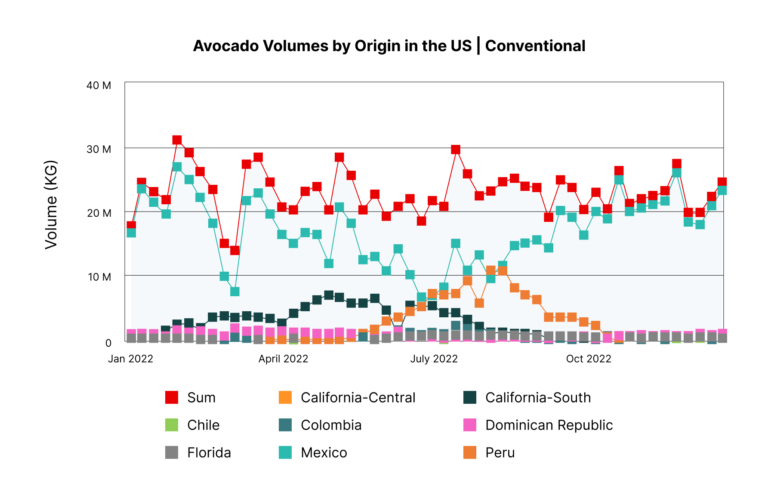

The main destination for Mexican avocado exports is the US. About 45% of Mexico’s avocado volumes are exported internationally, mainly to the US. In fact, The US’ imports of Mexican avocados are the biggest trade flow in the world.

According to the most recent data from the USDA, the US imported 1.1 million metric tons of avocados from Mexico in 2021, representing 89% of the US’ total avocado imports.

The US’ demand for Mexican avocados is mainly due to the fact that the peak of the Mexican avocado season complements the off-peak avocado season in the US. Mexican avocado exports occur between October and January. The high season for consumption in the US is between September and March, with specific peaks in demand during the Super Bowl and Cinco de Mayo.Meanwhile, avocado season in the US runs from April to September.

Source: Agronometrics

The US demand for avocados is expected to continue to increase in the coming years. This will further boost the leadership of the Mexican avocado, especially as farmers from Jalisco have begun to join farmers from Michoacán in exporting Hass avocados to the US. According to the Association of Avocado Producers of Jalisco, by July 2023, between 80,000 to 100,000 tons of Jalisco avocados are expected to be exported to the US.

Mexican avocado supplies entering the US are projected to increase by 5.2% annually between 2022 and 2028.

ProducePay’s Role in the Agricultural Sector

At ProducePay, we aim to provide a better produce trade for all stakeholders in the industry. ProducePay Marketplace is an online trading platform that allows growers and buyers to find each other to fulfill their selling and buying needs. Other Marketplace solutions include:

- Market insights, such as updated reports on price, movement, and more.

- Financing solutions that ensure easy and secure access to cash flow and ensure quick payouts.

- Sustainability programs to assist with meeting their ESG goals.

- Supply chain services that link sellers with pre-vetted third-party logistics partners to ensure a trusted delivery process.

During 2022 alone, we reached more than 700 customers in 10 countries and had nearly $4 billion in transactions through our online marketplace. Contact us to learn more about how ProducePay can help you improve your fresh produce business.

Sources:

Agronometrics. Agronometrics in Charts: 2022: Avocados in Review.

Avocado Institute. The Magic of Michoacán’s Four Blooms.

Farmdocdaily. Guacamole is Back: Seasonal Production from South America Lowered Avocado Prices.

Inspirafarms. Get key information on the 2022 Avocado Market Trends.

The Produce News. Mexican avocados continue on strong growth path

The Yucatan Times. Jalisco is sending 10 thousand tons of avocados to the US for the Superbowl this Sunday.