Current situation of the fresh avocado market in the U.S.

(Last update: May 15, 2025)

The U.S. avocado market continues to grow steadily, driven by rising consumer demand. However, domestic avocado growers are constantly facing challenges that have affected their competitiveness.

Climate events, water shortages, and lack of constraints have impacted production, leading the U.S. to increasingly rely on avocado imports from countries with more favorable growing conditions.

Domestic avocado production: rebound with challenges

In 2024, U.S. avocado production rose by 52.9%, reaching 197,070 metric tons. This marks a near recovery to the 200,000-ton peak of 2020 after three years of lower yields. Despite this improvement, domestic production is still very far from satisfying the growing demand and continues to face several structural hurdles.

Production depends almost exclusively on California, which accounts for 93.1% of total production, causing any climatic or water shortage eventualities in the region to impact nationwide.

The other two growing states, Florida and Hawaii, contribute only 6.7% and 0.2%, respectively, according to the National Agricultural Statistics Service (NASS).

Imports and exports trends

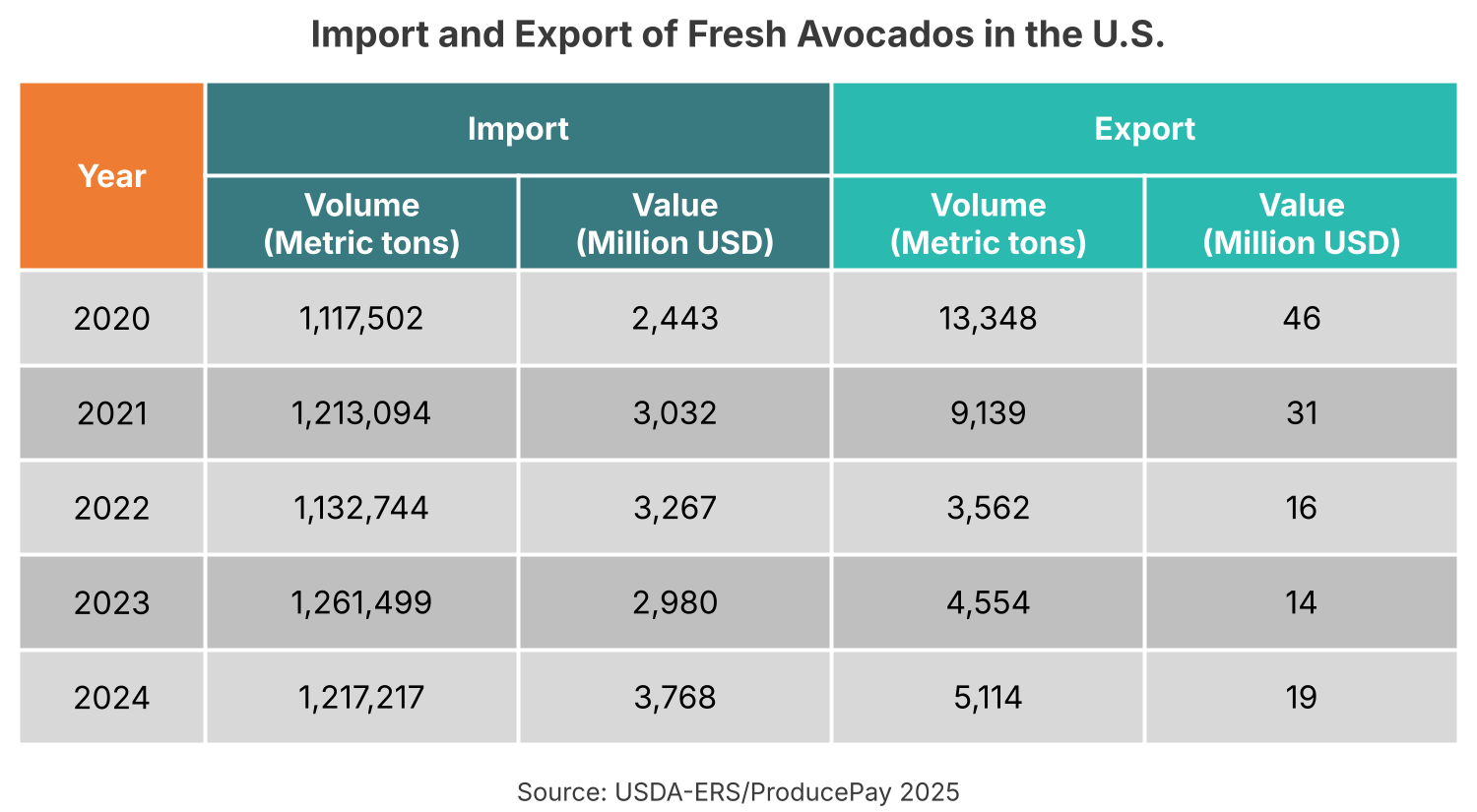

In 2024, the U.S. imported 1.2 billion metric tons of fresh avocados, valued at a record-breaking $3.87 billion USD. While volume was slightly down compared to 2023, this figure represents a strong upward trend over the past five years.

By contrast, U.S. exports amounted to just 5,114 metric tons, valued at $19 million. Although this reflects a modest recovery from the last 3 years, it highlights a consistent downward trend in exports.

Discover: U.S. fresh fruits and vegetables imports set to grow in 2025

Avocado suppliers to the U.S. market

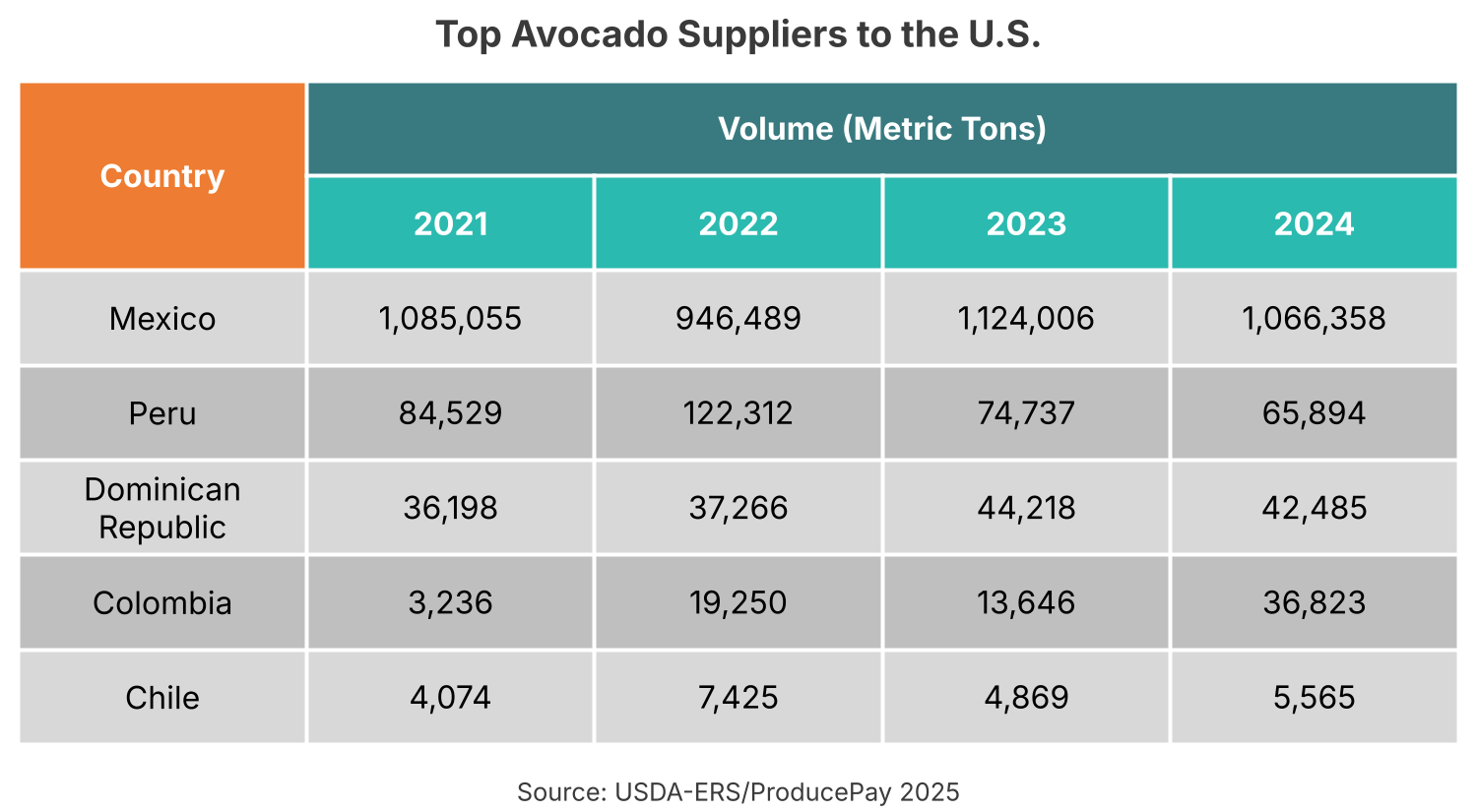

The main suppliers of fresh avocados to the U.S. market are Mexico, Peru, Dominican Republic, Colombia, and Chile, according to data from the USDA’s Economic Research Service (ERS).

Mexico, the king of avocados

In 2024, Mexico exported more than 1 million metric tons of avocados to the U.S., valued at $3.42 billion. Mexican avocados account for 87.6% of total avocado imports into the U.S., with peak volumes shipped between October and May, consolidating their leadership in the market.

Peru, a far runner-up

Peruvian avocados are sent to the U.S. mainly mid-year, providing a seasonal complement to Mexico’s low production months. This represents the 5.4% of total avocados entering the U.S.

Although volumes have declined slightly, the country remains a relevant supplier. It is important to note that the main destination for Peruvian avocados is Europe.

Colombia, a fast-growing competitor

Although the Dominican Republic contributes more, Colombian avocados are rapidly gaining ground in the U.S. avocado market, with a remarkable 169.8% growth in 2024 compared to the previous year.

Price for imported avocados

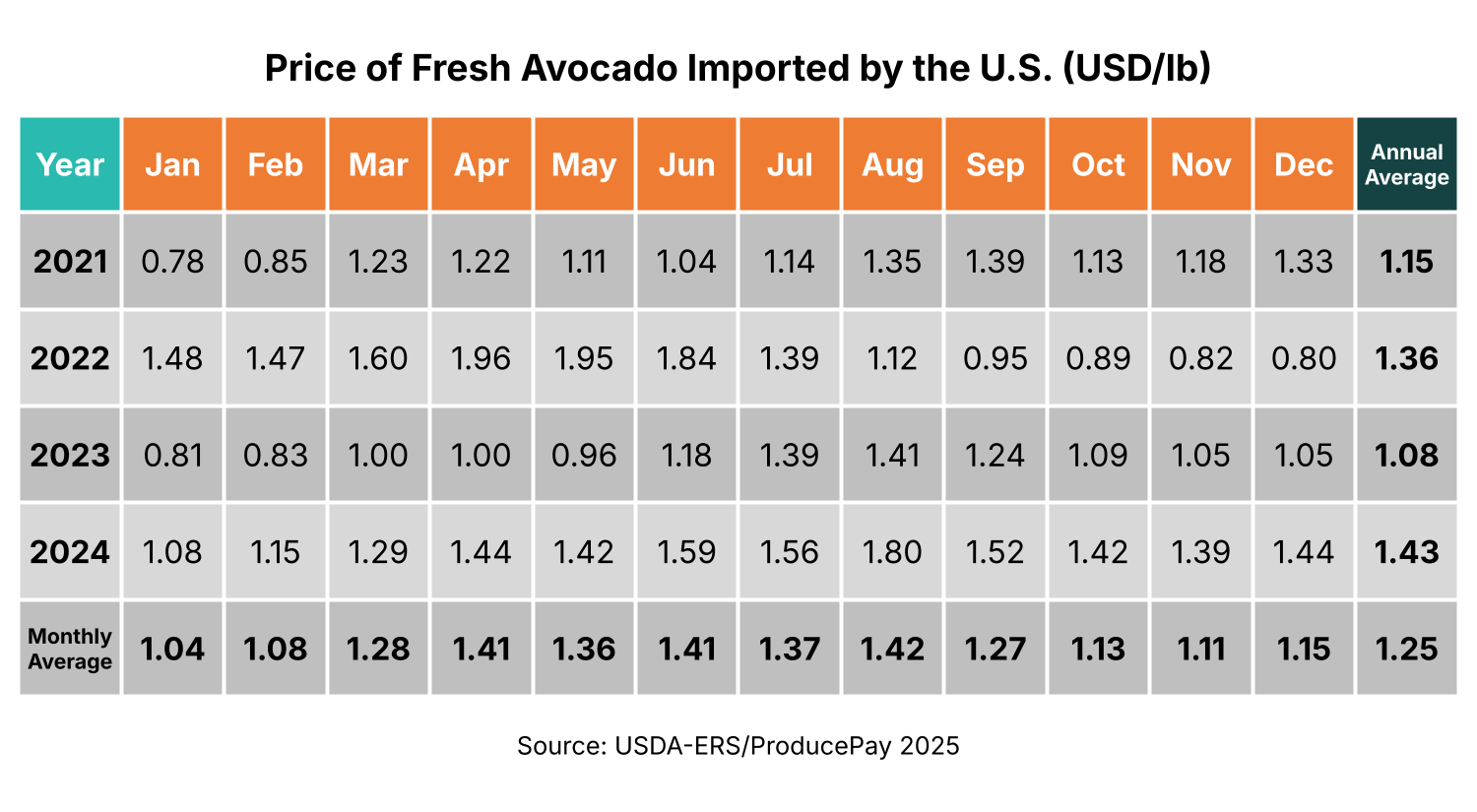

The average avocado price in 2024 for U.S. imports was $1.43 USD/lb. Typically, prices rise between April and August—when Mexico’s output declines—and drop from September through February due to higher availability during Mexico’s peak season.

This seasonal variation creates opportunities for exporters like Peru and Colombia to capitalize on supply gaps and benefit from higher market prices.

U.S. avocado market outlook for 2025

Over the past decade, the fresh avocado market in the United States has experienced steady growth, driven by increasing consumer demand that shows no signs of slowing. Per capita consumption has reached 9 pounds per year, fueled by the fruit’s recognized health benefits and culinary versatility.

Looking ahead to 2025, Mexican avocados will continue to dominate the U.S. avocado market. According to the USDA, avocados from Mexico are projected to increase by 5% over 2024, reaching 1.34 million metric tons, driven by an expected 5% boost in production.

Meanwhile, Colombian avocados are expected to keep gaining market share in the U.S. For Super Bowl 2025 alone, there was a 350% increase in avocados from Colombia shipped during January and February compared to the previous year.

Peruvian avocado exports are also projected to grow, thanks to Hass avocado growers seeking to expand production areas, with peak exports to the U.S. likely occurring from June to August. These efforts aim to help Peru recover from last year’s climate impact on avocado production, looking to achieve a total production of 1 million tons by 2030.

However, recent trade policies have introduced uncertainty in the avocado market through the implementation of tariffs on avocado imports, raising concerns about potential avocado price increases for U.S. consumers. Industry stakeholders are closely monitoring the situation, as higher costs could affect consumption habits and impact supply chain dynamics.

Enhancing predictability in the U.S. avocado market

As the avocado market continues to grow, so does the urgency for more stable supply chain dynamics. Volatility in pricing, availability, and logistics—particularly with key suppliers like Mexico, Peru, and Colombia—poses significant challenges. To meet growing consumer demand while minimizing risk, building more predictable sourcing models is essential.

At ProducePay, we believe the answer lies in fostering Predictable Commerce. Our Predictable Commerce Programs are designed to stabilize the volatility caused by imbalances in supply and demand, especially in commodities like avocados, where seasonality and market fluctuations can disrupt consistency. These programs align grower supply with buyer demand to enable a 52-week sourcing strategy with consistent pricing, greater transparency, and reduced waste.

Through integrated planning, real-time visibility tools, and a collaborative approach to procurement, these programs give U.S. buyers the reliability they need to plan and grow. We also provide complementary solutions to support grower success and ensure fulfillment, including Pre-Season working capital to fund crop production and Quick-Pay to accelerate payments to growers.

By investing in structured, transparent, and collaborative trade, buyers can gain secure access to high-quality avocado imports, support sustainable grower operations, and build resilience across the supply chain.