Fresh blackberry market in the United States.

According to the latest data on blackberry cultivation reported by the U.S. Department of Agriculture’s National Agricultural Statistics Service (USDA-NASS), production in 2017 was 20,125 US tons (18,257 tonnes), a decrease of 31.0% from the 29,108 tons (26,471 tonnes) in 2016.

Blackberry production in the United States extends throughout the summer and fall, extending from May through November, a volume that is produced almost entirely by the state of Oregon.

Fresh Blackberry Trade in the U.S.

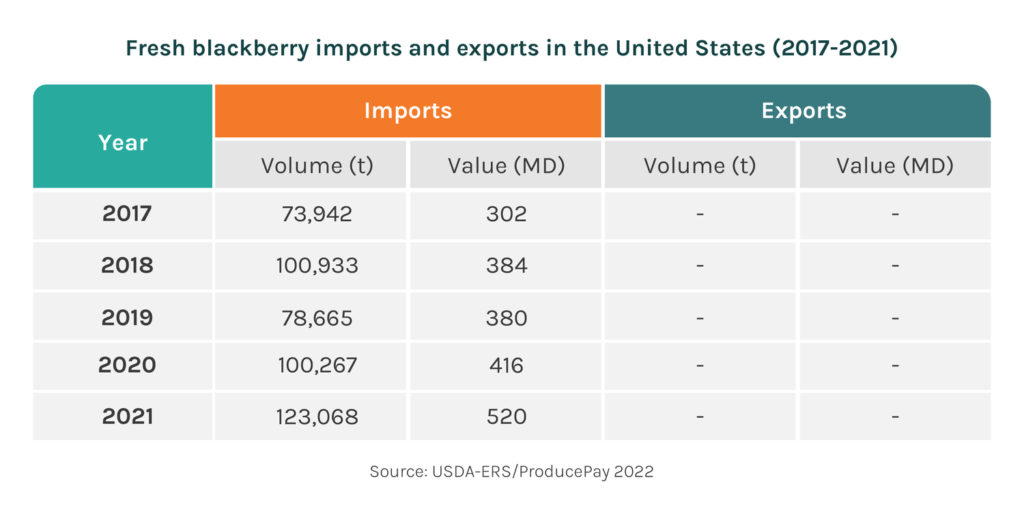

Over the last five years, fresh blackberry imports have increased in 66.4%, going from 73,942 tonnes in 2017 to 123,068 tonnes in 2021, however, in 2019 there was a decrease in volume of 22.1% compared to 2018.

Regarding the value of these imports, it has increased from US$302 million in 2017 to US$520 million in 2021, except for 2019, where it decreased slightly with respect to 2018.

On the other hand, there is currently no data available on the U.S. blackberry exports to other countries.

Main Fresh Blackberry Suppliers to the U.S.

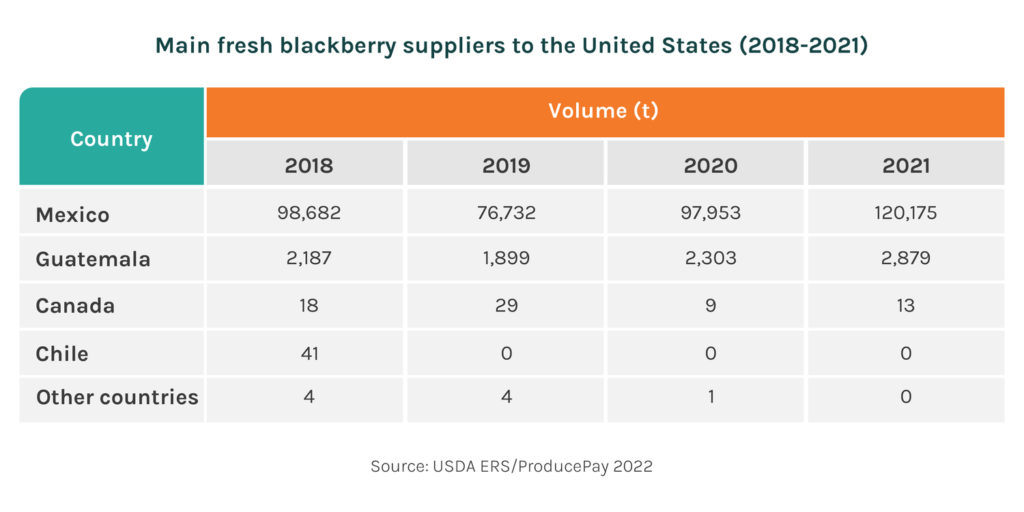

The United States imports fresh blackberries mainly from Mexico, a country that complements the supply of blackberries as the product is received mostly out of season in the United States.

Mexico

Mexico is the second largest exporter of blackberries globally, so it is not surprising that it is the main supplier of blackberries to the U.S. market, with a volume of 120,175 tonnes in 2021, which represented 97.7% of total imports and a value of 508.5 million dollars.

Mexico has firmly maintained its position throughout the last 5 years, even increasing its volumes across the board despite a significant decrease in 2019, so it will surely seek to continue consolidating over the next few years.

Guatemala

With a much smaller volume, Guatemala is positioned as the second supplier of fresh blackberries to the United States, contributing 2,879 tonnes in 2021, which represented 2.3% of total imports in that year and a value of 11.3 million dollars. Guatemala, like Mexico, has been increasing its volumes, although in much smaller quantities and with a decrease also in 2019.

Canada, Chile and Colombia

Both Canada and Chile make minimal shipments of fresh blackberries to the United States each year, although as of 2018 no shipments have been reported from Chile; the same case for Colombia, a country from which the last year with recorded volumes was 2017.

Fresh Imported Blackberry Price in the U.S.

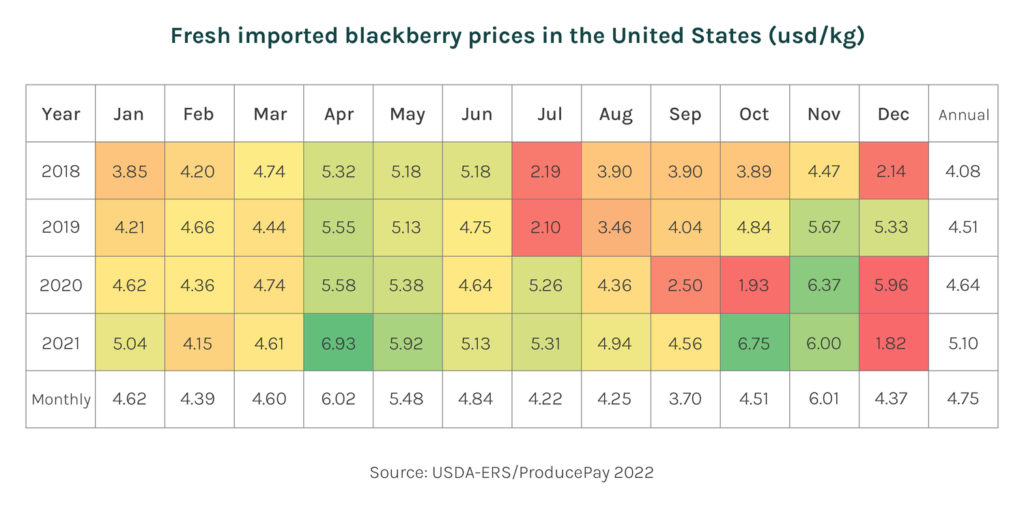

The price of fresh blackberries imported by the United States has seen a large increase throughout the last years, having that the average annual price increased from 4.08 usd/kg in 2018 to 5.1 usd/kg in 2021.

In 2021, April and October were the months in which the highest prices were reached, with 6.93 and 6.75 usd/kg, respectively. On the other hand, the lowest price was in December with 1.82 usd/kg.

The seasonality of prices has varied from year to year, although, in general, prices tend to fall in the middle of the year, when the least amount of blackberry is imported, and are higher at the beginning of spring and towards the end of the year.

Summary

Blackberry production in the United States is low, with no data available since 2017, which has led to an increase in imports over the last few years, with Mexico being the main supplier of this product.

Additionally, everything seems to indicate that these imports will continue to increase, something that could imply a great growth opportunity for countries supplying fresh blackberries to the United States.