The Chilean agroindustry: production and exports.

Chile’s diverse climate and soil conditions allow for the production of a wide range of high-quality agricultural products and have positioned the country as an essential player in the global food market.

The South American nation also benefits from commercial agro-export agreements with more than 60 countries, which give its growers preferential access to foreign markets and enable them to remain competitive in the global agricultural export industry.

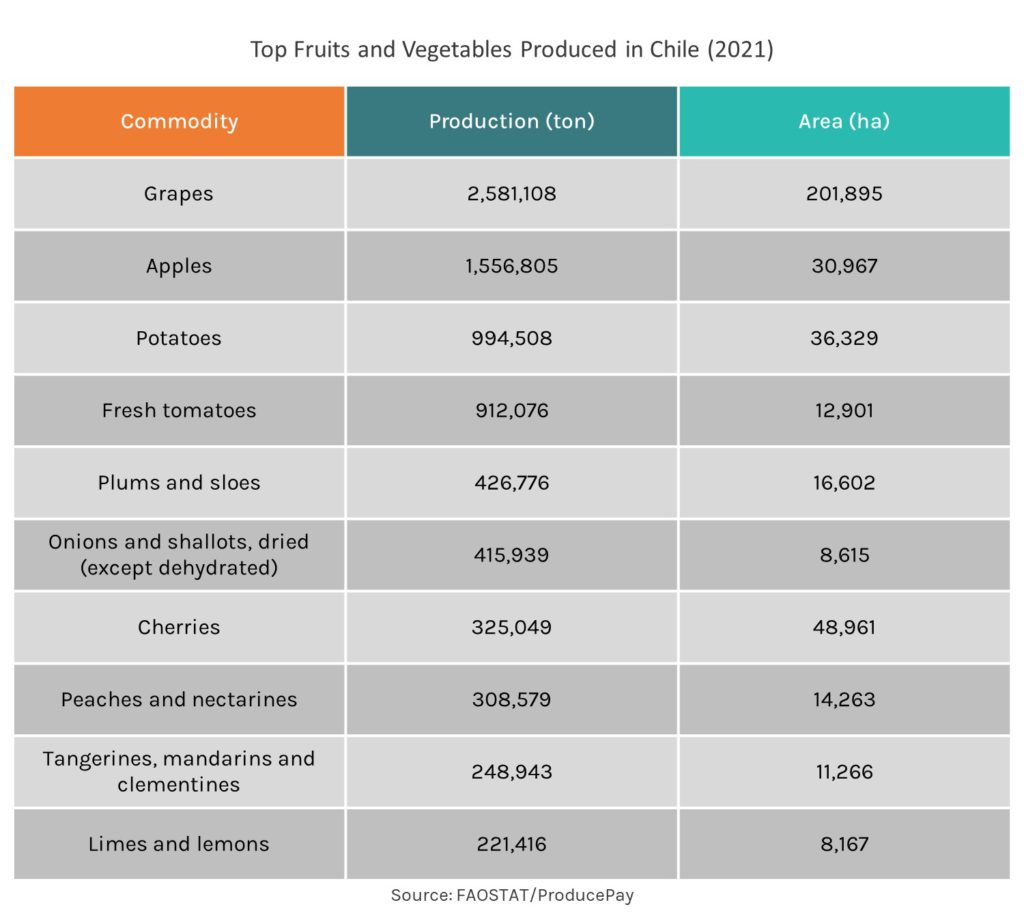

Highest volume fruit and vegetable crops in Chile

Grapes are Chile’s largest fresh produce crop by volume. Growers harvested 2,581,108 metric tons in 2021, equivalent to 18.1% of national agricultural production.

Chile’s grapes are grown on 201,895 hectares of land, yielding 12.8 tons per hectare.

After grapes, apples, potatoes, tomatoes and plums are the highest-volume crops, collectively representing 27.4% of national production.

Other significant agro-products include onions, cherries, peaches, tangerines, lemons, pears, avocados, kiwifruits, oranges, olives and blueberries.

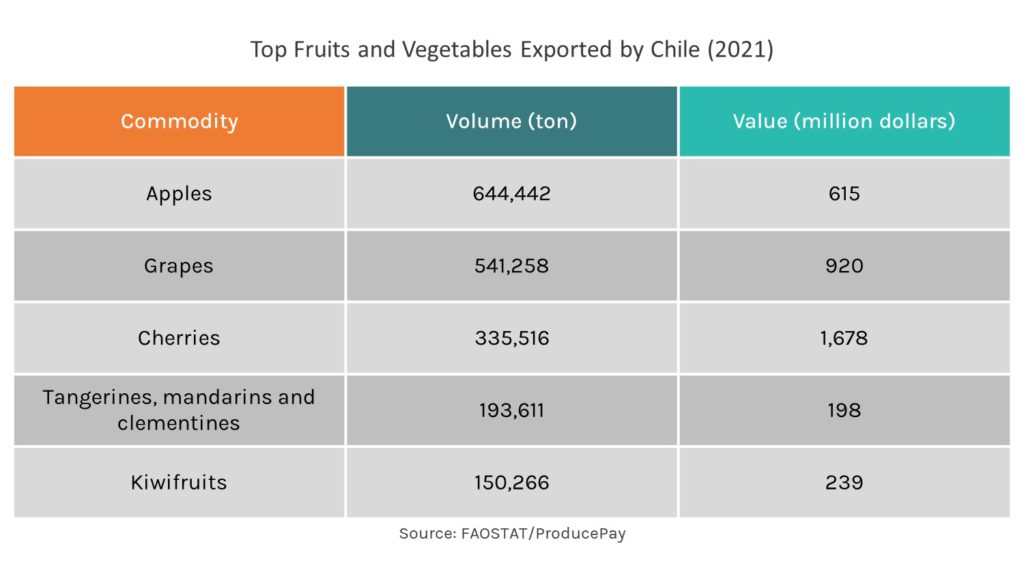

Major fruits and vegetables exported by Chile

In 2021, apples were Chile’s largest export crop by volume, with shipments of 644,442 metric tons accounting for 15.3% of total agri-food exports.

Grapes, cherries, tangerines and kiwifruits round out the top five, adding up to 21.5% of total export volume. Other high-volume fruits and vegetables include pears, plums, blueberries, oranges, limes, avocados, peaches and walnuts.

Cherries have the highest value of all Chilean export products, earning $1.68 billion, 13.3% of the total value of all fruit and vegetable exports. Grapes came in second place with a value of $920 million, representing 7.3% of the total value.

The next highest-earning products were apples, blueberries, avocados, kiwifruits and plums. These five crops together represented an export value of $1.93 billion, equivalent to 15.2% of Chile’s fresh produce exports.

Chilean agro-exports to Europe

European exports are hugely important to Chile, and it’s essential to continue developing and strengthening the agro-export sector to maintain an active presence in the market.

The Netherlands is the leading destination for Chilean agro-exports, with 303,489 metric tons imported in 2021, accounting for 25.8% of total shipments.

However, the United Kingdom, Germany, Russia and Spain are also major destinations for Chilean fruits and vegetables, and these four countries purchased 45.3% of Chilean agricultural exports.

The largest export product by volume to these countries is apples, which total 24.0% of shipments, followed by grapes, avocados, blueberries and pears.

However, avocados generated the highest export value, accounting for $197 million, followed by blueberries at $192 million, apples at $125 million, grapes at $118 million and kiwifruits at $57 million.

In economic terms, the Netherlands is still the main market for Chilean agro-exports, with a value of $660 million in 2021, equivalent to 24.9% of the total value.

The United Kingdom ranks second, with $475 million, followed by Germany with $311 million. In addition, countries such as Italy, Spain, Russia and France all imported over $100 million of Chilean produce in 2021.

What challenges does the Chilean agro-exporting industry face?

Chile’s agro-exporting industry faces several challenges that may negatively impact its long-term development and growth. The three most relevant are:

- International competition: Chilean agribusiness must compete with other food and raw material-producing countries. Globalization has given consumers access to a wide variety of products from around the world, so Chilean growers must offer products at competitive prices without compromising quality.

- Climate change: Chile is experiencing the effects of climate change, which can damage crop production and quality. Droughts, floods and other extreme weather events can affect the production of food and raw materials, impacting the country’s economy.

- Financing: Access to financing is a major challenge for Chile’s agro-export industry. Lack of adequate financing can limit investment in technology, machinery and worker training, impacting crop quality and productivity. Access to financing for the agro-export industry needs to be promoted through appropriate financial instruments, such as loans and long-term credit, to allow continued investment in the sector and ensure its sustainable growth.

Why is financing so important for the Chilean agro-exporting sector?

Chile’s agro-export sector has become one of the critical pillars of the country’s economy. It’s an essential source of income and generates employment opportunities throughout the country. However, the sector faces many challenges.

For example, the table grape industry is undergoing a varietal replacement that requires significant financing, as growers adopt new domestic and foreign varieties to meet the demands of consumers and exporters.

Varietal replacement is complex and requires a large economic investment in new technologies, which can be a struggle for small and medium-sized growers.

Table grape production in Chile has also been hit by multiple adverse factors, such as drought, low labor availability, international competition, changing consumption, and increased certification requirements.

The industry needs investments to remain competitive in an increasingly demanding market. This requires access to working capital and a healthy cash flow. ProducePay’s Pre-Harvest Financing or Quick-Pay Marine factoring allows growers to expand their operations globally without undercapitalization.

Fuentes: FAOSTAT, FAOSTAT, Portal Frutícola