Mango market situation in the United States and Latin America.

The US mango import market has grown consistently over the past few years, with Latin American growers serving as the primary suppliers.

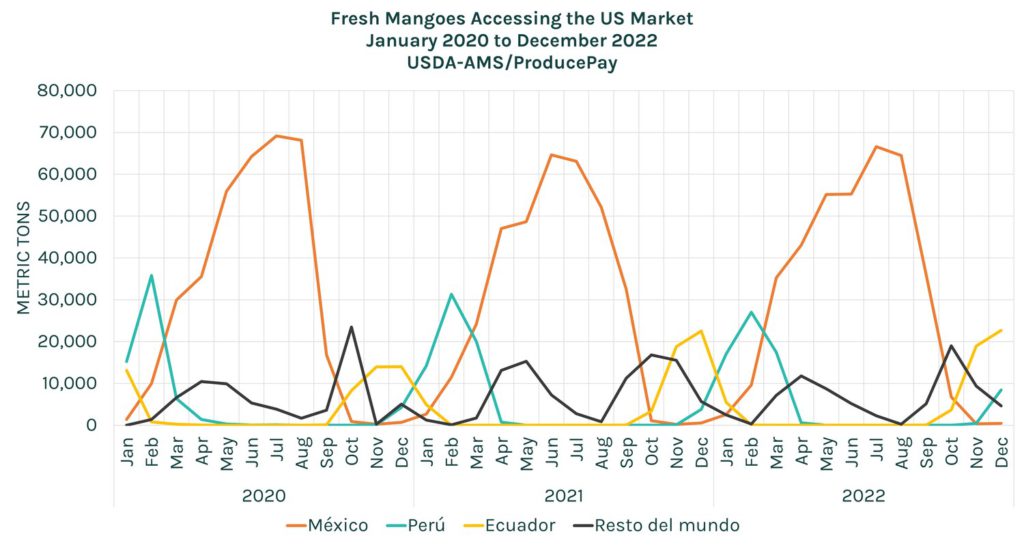

Volume of mango imported by the US

In 2022, the US imported 573,792 metric tons of fresh mango, representing an increase of 2.5% over the 559,732 metric tons imported in 2021 and a 6.5% increase over the 538,721 metric tons in 2020.

Mexico is the leading mango supplier to the United States with a 65.5% market share, sending its product mainly between March and August, with the highest volumes arriving in July and August.

Mexico is followed by Peru and Ecuador, with a market share of 12.4% and 8.9%, respectively. The Peruvian mango season runs from December to March, peaking in February. The Ecuadorian mango season runs from October to January, with a peak between November and December.

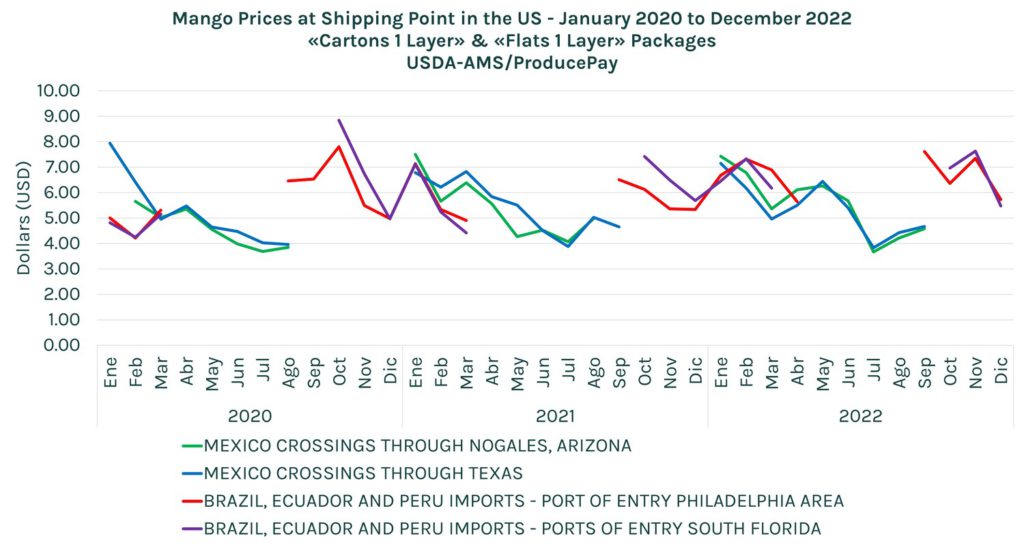

Price of mango imported by the US

Mangoes are marketed to the United States through Cartons 1 layer and Flats 1 layer. Carton 1 is mainly used for mangos from Mexico, and Flats 1 for mangos from Brazil, Ecuador and Peru.

Throughout the year, there are usually two periods of high prices: the first occurs between January and April due to the low supply of Mexican mangos, while the second one is between September and November, when Mexico does not send any product, thus increasing the demand for South American mangos.

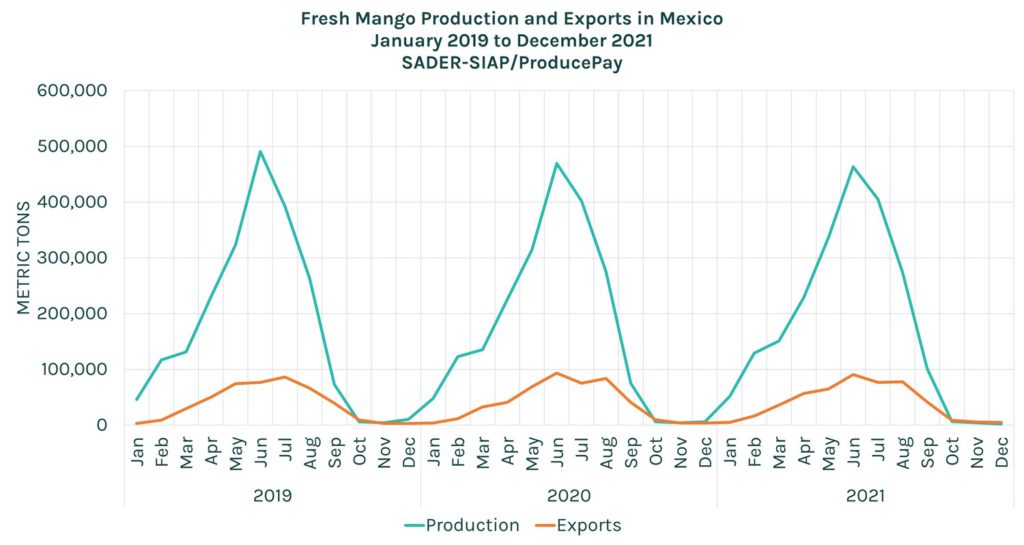

Mango production and exports in Mexico

In 2021, Mexico produced 2,153,884 metric tons of mango, 3.3% more than in 2020. Sinaloa, Guerrero and Nayarit are the top-producing states, with 423,518, 404,561 and 334,915 metric tons, respectively.

Additionally, Mexico exports 22.5% of what it grows, which was 485,395 metric tons in 2021.

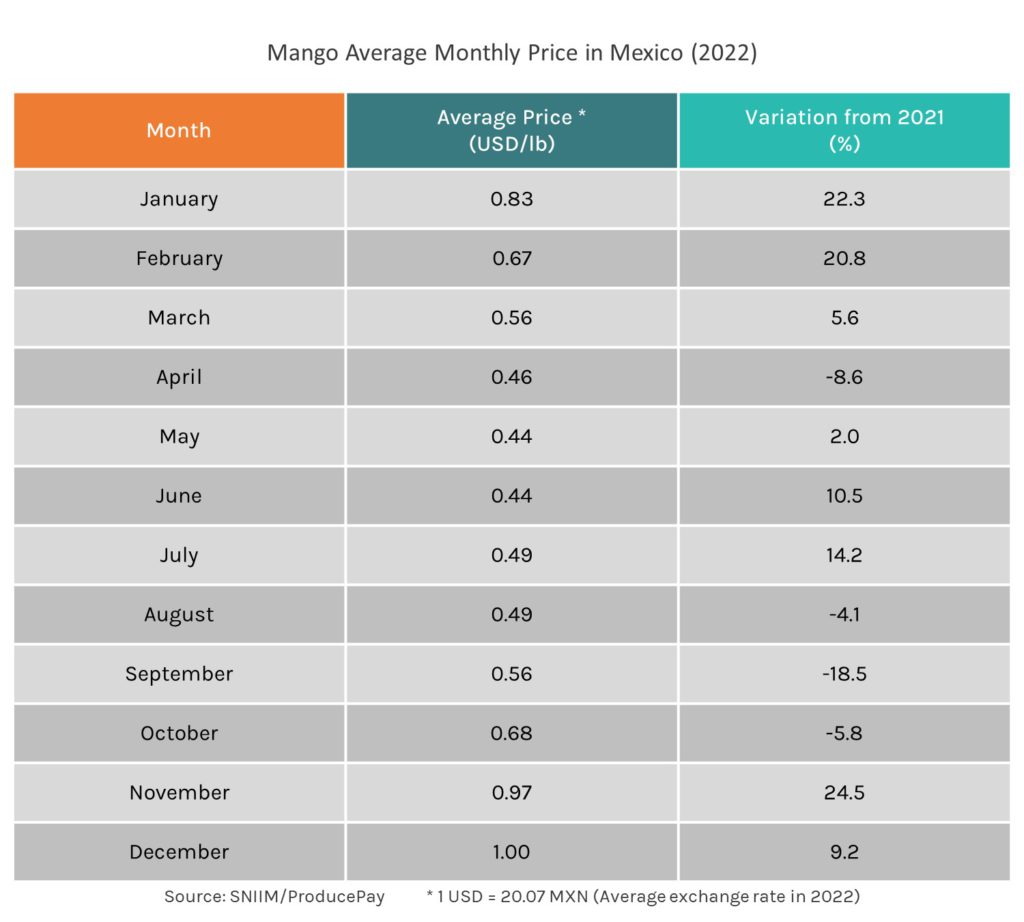

Mango prices in Mexico

In 2022, the average annual price of premium Ataulfo mangos marketed in Mexico was $0.56 per pound, a 9.9% increase over the $0.51 per pound in 2021.

The month with the highest price per pound in 2022 was December at $1, while the lowest was in June at $0.44. Additionally, the months with the highest percentage increase compared to 2021 were November, January and February, with more than 20% increases.

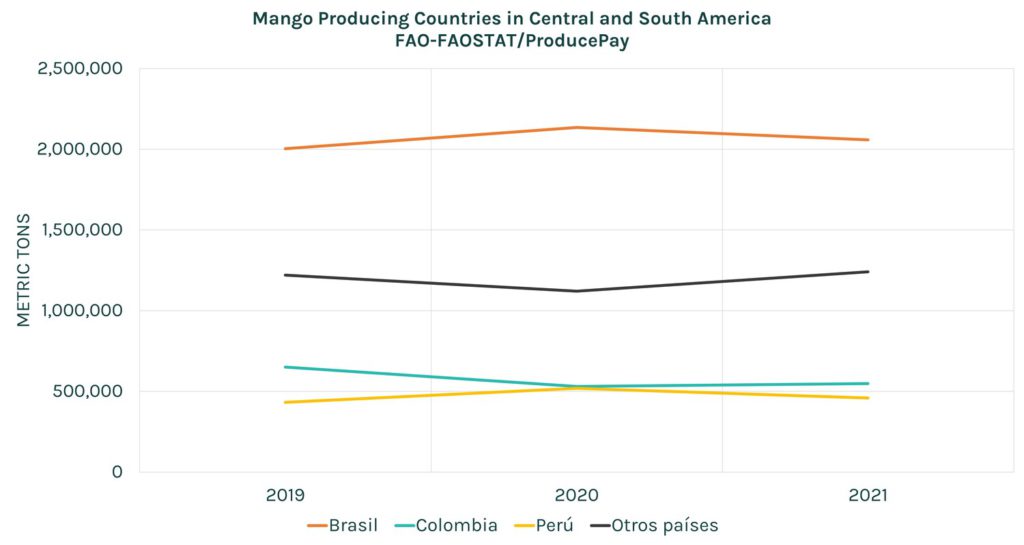

Production in Central and South America

According to FAOSTAT data, Brazil, Colombia and Peru are the largest mango producers in Central and South America, growing 2 million (48%), 649,730 (13%) and 431,884 (11%) metric tons in 2021, respectively.

However, production in Brazil and Peru declined in 2021, although not below the harvest they obtained in 2019. Meanwhile, Colombia is trying to recover from its considerable decline in 2020.

Learn more about the current mango situation

Download our whitepaper on the current state of mango production and marketing to learn everything you need to know about the mango market and have the information your business needs. Click here to download it today.

Sources: USDA-AMS, FAO-FAOSTAT, SADER-SIAP, SE-SNIIM