Is Predicting the Price of Agricultural Products Like Predicting the Price of Stocks?

Anyone who has ever bought shares in a stock market knows how uncertain it is to invest there. From one day to the next, prices can change drastically, due to factors that are often too intricate for us to understand.

This implies that predicting future stock prices is enormously complex, even for those who know a sector well, just like it is difficult for agriculturalists with decades of experience to accurately know where the market is headed the next day.

In order to estimate stock and agricultural product prices, we need to have updated information on factors that influence produce prices such as historical and current prices, availability, competitors, and special dates.

In other words, factors other than supply and demand can modify the market trend. We need to analyze enough variables to know which variables affect the market trend the most and not feel overwhelmed by tracking too many variables, which would make us reach the point of “paralysis by analysis.”

To understand more about this topic, we will review the avocado market in the United States. We at ProducePay have been developing models to estimate how the avocado prices will change within 5 days.

U.S. Avocado Market Overview

In 2001, avocado production in the United States began to decline, and has not yet stopped. This allows farmers in California, a state with a high concentration of farmers, to charge higher sales prices.

The decrease in domestic production means the United States imports from other countries. This only helps producers in other countries, as the United States often pays higher prices for high-quality avocados, helping them make more money.

In 2007, Mexico overtook Chile as the leading avocado exporter to the United States and currently constitutes around 80% of America’s imports. In 2018, Peru became the United States’ second-largest supplier.

Because Mexico and the United States are neighbors, Mexico has an enormous advantage of shipping its product in front of end consumers in just a couple of days. Additionally, they can ship avocados throughout the year, mainly from October to February and to a lesser extent between June and September.

Avocado consumption in the US is still lower than that for other products such as apples, bananas, lemons, cranberries, and grapes, meaning there is still a huge growth potential in US’ Avocado volume consumption.

Pricing in an agricultural market

To understand the fundamentals of agricultural commodity price estimates, it is essential to understand how prices are determined.

It is not uncommon for buyers and sellers of avocado to disagree on the price of the product. Some reasons are as follows:

- Sellers need to sell above their production price, although buyers are not always willing to cover this price.

- If the price of a product starts to rise, sellers will wait to try to market it at the highest possible price.

- If the price of a product starts to fall, buyers will wait to try to acquire it at the lowest possible price.

This means that pricing is not only based on the quantity of product available at a given time, but also on the market’s perceptions of the short-term price trend.

Historical movement and price trends

The U.S. market consumes avocados all year round. However, demand often soars during the Super Bowl, which is one of the most important sporting events in the United States and falls on the first Sunday of February.

The data supports this too. During week 4 of 2021 — one week before the game — 41,640 tons were imported, representing a 68.8% increase from week 3, which saw 24,675 tons being imported.

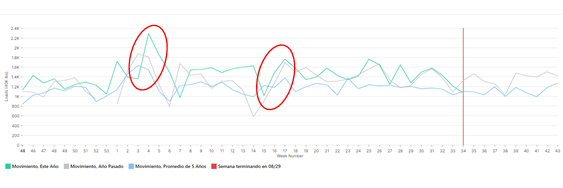

Trend of avocado volumes in the United States (Source: Daily Market Report)

Before the Super Bowl, avocado prices stay low, encouraging more people to buy them for their watch parties and sporting events. After the Super Bowl, however, the prices increase drastically, because a majority of the avocado supply had already been bought the weeks before, so there are much fewer avocados than before.

For example, in 2021, from February 1 to 7 (the week when the game occurred), the average price of premium avocado (Cartons 2 Layer * 60s) was US$20.95, the following week it increased to US$24.65, then US$29.63 the week after, and US$30.75 the week after that.

The second highest peak of avocado consumption occurs on May 5, which is one of the most widely celebrated Mexican holidays in the United States.

In 2021, this date was commemorated in week 18. One week earlier, in week 17, there was a peak of 32,078 tons of avocado imported. This beat the previous year’s records of 27,124 tons of 2020, which took place around the same time of the year — week 17.

Avocado price trend in the United States (Source: Daily Market Report)

After this date, there is a slight decrease in Mexican avocado prices, partly due to the low season and partly because in the beginning of April, retailers rely more on domestically grown avocados than Mexican imported avocados.

The change in supply was met with a change in price. In 2021, the price of the first quality (Cartons 2 Layer * 60s) in the week of May 3-9 was US$37.95 for Mexican avocado, which decreased in the following weeks, and US$39.25 for California avocado, which remained.

How to estimate the price of avocado on your own

Every dollar matters.

Mexican exporters want to know how the avocado prices will change in the near future, so they can make the best trade possible. A single dollar multiplied by the volume they trade at can be a difference of thousands of dollars.

To estimate avocado prices, there are many variables that can be considered, but it is important to determine those that have the strongest correlation and discard those that are not useful.

In this regard, ProducePay’s engineering team has determined that the variables that have the strongest relationship with the determination of avocado prices are supply, prices, important dates, and other similar products.

Recent supply

The USDA’s daily movement report provides information on the number of avocados entering the U.S. market and where they are importing from.

Recent prices

The USDA offers daily avocado price reports, which shows the current prices at both shipping points and terminal markets for the most commonly found avocados.

Important dates

As we have already seen, specific dates impact the avocado prices and supply. We found that if an important change in price were to happen, then it would happen within 2 weeks of an important date.

Similar products

The ProducePay team found that the price trends of some commodities, such as oranges, are somewhat similar to that of avocados. We can track which commodities are most relevant and monitor changes in their prices.

Avocado price prediction tool

At ProducePay we developed a statistical model to predict the 5-day avocado price fairly accurately. To develop the calculations, we tested hundreds of variables that could potentially change avocado prices and determined which ones are the most important.

This has been possible thanks to the implementation of machine learning tools, which allow us to discover which variables have the greatest impact on the price prediction of this product.

Example: With the prediction tool, if on July 27 you wanted to estimate the price for July 28, then you would have to consider the average prices and supply of avocado on the previous 3 days, as well as the average price of oranges.

The above considering the 48s caliber of conventional production through McAllen, Texas. The variables to be considered and their importance are: avocado price has 65%, avocado supply 25% and orange price has 10%.

With these considerations, our one day model predicted the July 28th’s price to be $38.46. The USDA showed the shipping price as $40.25, and the actual price that our team saw in the market was $35.

But more importantly, our full statistical model yielded a value of $34.51 for that date, so our method was the most accurate in predicting the future avocado price, which is so because we considered many more variables.

However, even with the estimation tool we share with you, it could be complicated for you to be making the predictions on your own, so we invite you to be part of our Preferred Network, where you will have access to the information you need.

About our work with price estimates

At ProducePay, we know the importance of knowing how the avocado prices are changing for your business, so we have brought together several specialists with the ability to analyze, interpret and improve the data to make your lives easier. .

We currently have 30 specialists on our technical team who are building software and gathering strategic information to simplify the lives of produce buyers and sellers… and we are continuing to.

Of these, 15 are engineers, graduates of universities such as the University of California at Berkeley, the University of California at Los Angeles, and the University of Illinois at Urbana Champaign, many of whom have more than a decade of professional experience.

Get our avocado price report

If you want to be updated with avocado prices in the U.S. market, subscribe for free to our Daily Market Report and receive daily information broken down by type of production, size, and shipping point.

At ProducePay, we rely on the daily USDA price report, but internally our specialists have built our model such that we can predict the price of avocados up to 5 days out with a more narrow range than what the USDA provides. Our estimates vary between $2.50 and $3, while the USDA’s estimates vary between $4 and $5.

Authors

Amal Bhatnagar

Data Product Manager at ProducePay. Dual degree in Data Science and Economics from the University of California at Berkeley.

Olmo Axayacatl

Host of Podcast Agricultura and director of Agricultura Profesional. He holds a master’s degree in horticulture from Universidad Autónoma Chapingo.