Bell pepper price and market trends in the US: 2023 analysis.

The consumption of bell peppers in the American market continues to rise, driven by several factors, but primarily due to the wide range of varieties that allows it to meet consumer needs.

While there are states that produce significant volumes of this vegetable, the growing and persistent demand has led to increased imports year after year, with Mexican growers reaping the most benefits.

In the 1960s and 1970s, with the surge of interest in gastronomy and diverse culinary cultures, bell peppers found a prominent place in American cuisine. They were not only appreciated for their flavor but also for their aesthetic appeal, especially in dishes that incorporated vibrant colors.

In 2022, bell pepper production in the United States reached 528,700 metric tons, representing a slight increase of 7.0% compared to 2021 and a slight decrease of 1.6% compared to 2020.

The leading bell pepper-producing states in the country are Florida, California, and Georgia. In 2022, Florida (38.4%) surpassed California (33.9%), with Georgia contributing 10.5%. These three states accounted for 82.8% of the total production, according to data from the National Agricultural Statistics Service (NASS).

Imports and exports trends

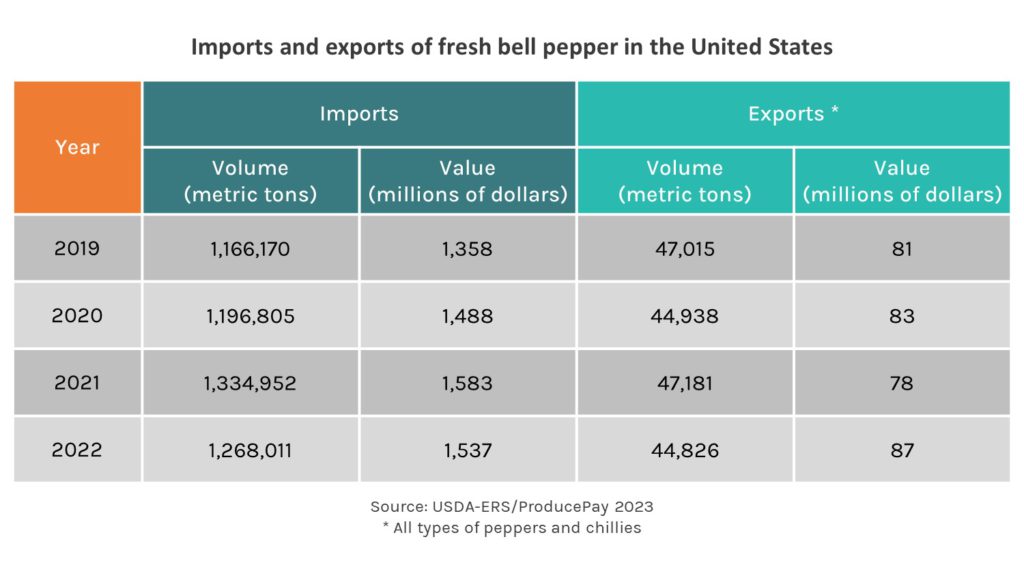

In 2022, the United States imported 1,268,011 metric tons of bell peppers, valued at $1.54 billion, representing a 5.0% decrease compared to 2021, although the value decreased by only 2.9%. These statistics were obtained from the Economic Research Service (ERS).

On the other hand, exports in 2022 amounted to a mere 44,826 metric tons and $87 million, although it’s worth noting that these figures encompass all types of chili peppers and bell peppers, with bell peppers being the most voluminous.

US Suppliers

According to data from the Agricultural Marketing Service (AMS), the top 5 suppliers of fresh bell peppers to the U.S. market are Mexico, Canada, Honduras, the Dominican Republic, and the Netherlands.

The graph below illustrates Mexico’s dominant position in the market, with its highest volumes between December and March, although Canada has significantly increased its exports in recent years, taking advantage of the Mexican off-season.

Mexico’s Competitive Advantage

Mexico enjoys several competitive advantages, starting with its geographical proximity, which significantly reduces transportation costs and transit times. Additionally, trade agreements with the United States have facilitated the creation of efficient supply chains.

Canada’s Growing Relevance

Canada’s presence in the market has grown due to investments in infrastructure, technological innovations, and sustainable practices, allowing them to strengthen their quality standards and make their products attractive to consumers.

Honduras with Minimal Shipments

Honduras’ volume is minimal compared to Mexico and Canada, although its geographic proximity to the United States allows certain companies to export their production.

Average monthly prices

The annual average price for avocados imported by the United States was $0.68 per pound in 2022. The months with the highest prices were July, June, and November, while the lowest prices were observed in January, February, and March.

This price behavior is influenced by the fact that Mexican production and exports decrease during the middle of the year due to the low season, and Canada’s production is still insufficient to compensate. Conversely, at the beginning and end of the year, Mexican avocado production increases, leading to price decreases.

Market Outlook for 2024

The fresh bell pepper market in the United States has become an ever-evolving and competitive scenario. Throughout 2024, we anticipate several significant changes and trends that will impact competing nations in this market niche. The United States imports a substantial quantity of its fresh bell peppers, and the dynamics of these trade exchanges are influenced by various economic, environmental, and geopolitical factors.

Firstly, Mexico has historically been the primary supplier of fresh peppers to the U.S. market, thanks to its geographical proximity and trade agreements like the USMCA. However, adverse climatic conditions, such as droughts and extreme weather events, could impact Mexican production in 2024, potentially creating opportunities for other competing nations.

Countries like Canada and the Netherlands have been increasing their production and export capacity for fresh bell peppers through advanced agricultural technologies like controlled greenhouses and vertical farming. These innovations have enabled year-round bell pepper cultivation, reducing dependence on weather conditions.

Furthermore, consumption trends in the United States are evolving. There is a growing demand for more exotic and unique bell pepper varieties, opening doors for countries that produce less common varieties. Spain and Morocco, for example, have been introducing sweet and spicy bell pepper varieties not typically found in the U.S. market, capturing the attention of consumers seeking new flavors.

Additionally, the increasing concern for sustainability and food traceability in the United States has led to an increased demand for organic and fair-trade bell peppers. This could benefit countries that embrace sustainable agricultural practices and recognized certifications.

Is bell pepper a part of your business?

If you produce and sell peppers, you can obtain working capital and optimize your cash flow. Conversely, if you buy and trade peppers, you can connect with our network of sellers and make quicker payments to them. With ProducePay, our solutions include:

- Trading Platform: Streamline your supply chain by connecting directly with our verified sellers.

- Pre-Season: Secure tailored working capital for your business to manage operational and harvesting expenses.

- Quick-Pay: Enhance your cash flow by receiving fast payments for your shipments, with options upon shipping or upon buyer’s acceptance.

- Insights: Real-time market intelligence that augments USDA data in a more user-friendly format.