Lime market insights for the United States and Latin America.

Limes are an in-demand agricultural crop due to their extensive use as a cooking ingredient and direct consumption. They stand out for their culinary versatility and richness in vitamin C and antioxidants. Economically, limes are important in multiple regions, generating employment and strengthening local and national economies.

Although international trade drives global growth, limes face challenges such as climate variability and diseases that limit yields, including canker and HLB. Phytosanitary requirements and trade barriers complicate market access, and competition and unstable prices impact profitability. Research, sustainability and effective management are crucial for its future and food security.

Lime volumes imported by the United States

Mexico primarily supplies Persian limes to the U.S., accounting for 92.6% of imports (622,479 metric tons) in 2022, a decrease from 97.5% in 2020. Meanwhile, Colombia has increased its share from 1.8% in 2020 to 5.2% in 2022.

Peru also contributes but to a lesser extent. Countries such as Honduras, Guatemala, etc., ship limes in minimal volumes. With no domestic production, the United States relies heavily on imports.

Price of limes imported by the United States

USDA reports prices for conventional Persian limes in 40 lb packages crossing from Mexico via Texas. Recent years have witnessed prices surge in February, March and April, with 2022 prices nearly doubling 2021’s.

In March 2022, prices reached $74.40 versus $42.16 in 2021. Prices revert to their regular levels during the year’s second half, coinciding with the Mexican harvest season.

Lime production and exports in Mexico

In 2022, Mexico produced 3,101,099 metric tons of limes, a 5.0% increase over 2021 (2,954,431 metric tons). The leading states for production were Veracruz (27.7%), Michoacán (27.6%), and Colima (10.0%). Michoacán led in terms of harvested area with 54,160 hectares and a yield of 15.8 tons per hectare.

Buenavista, Michoacán, was the central producing municipality, contributing 9.2% of the total (286,260 metric tons). In 2021, Beunavista exported 756,148 metric tons, 26% of the total volume. In 2020, exports accounted for 28%.

Lime prices in Mexico

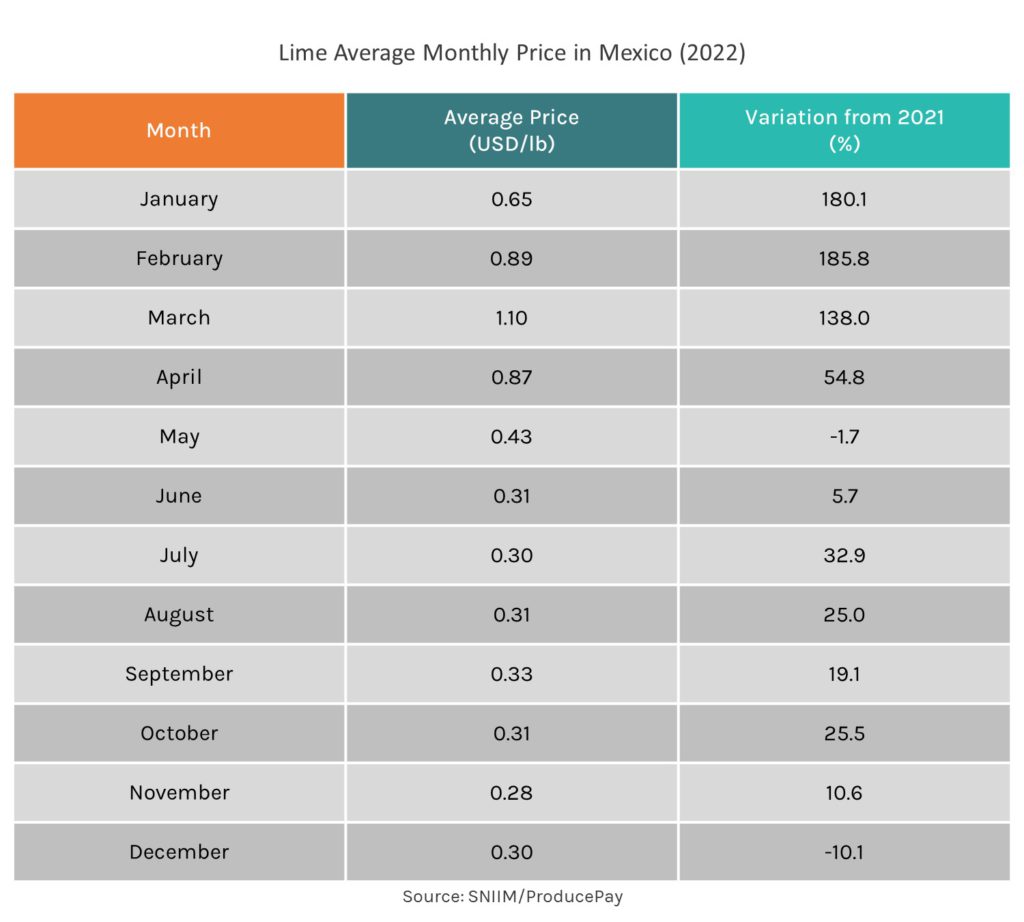

During 2022, the average annual price of ” Prime Seedless Lime” in Mexico was $0.51 per pound, an increase of 53.9% over the previous year (0.33 $/lb). The price fluctuated across the year, peaking in March (1.1 $/lb) and hitting a low in November (0.28 $/lb).

Early months experienced higher prices due to low production, while prices remained stable from June to December due to consistent supply.

Production in Central and South America

Within Central and South America, Brazil, Argentina and Colombia lead lime production, with 1,499,714, 1,378,021 and 1,006,838 metric tons in 2021, respectively. Colombia’s share increased from 8% to 11% between 2019 and 2021, while Brazil and Argentina maintained or reduced their share.

Countries such as Peru, Chile, Guatemala, and Costa Rica contribute significantly, with a 20-24% share. The rest of the countries have lower production.

Learn more about the current lime situation

Download our Free 2023 Lime Analysis to learn crucial insights about lime production and marketing and get the information your business needs to thrive. Click here to download it now.

Sources: USDA-AMS, FAO-FAOSTAT, SADER-SIAP, SE-SNIIM