Grow More. Risk Less.

The world’s leading fresh produce companies are partnering with ProducePay

to grow their business.

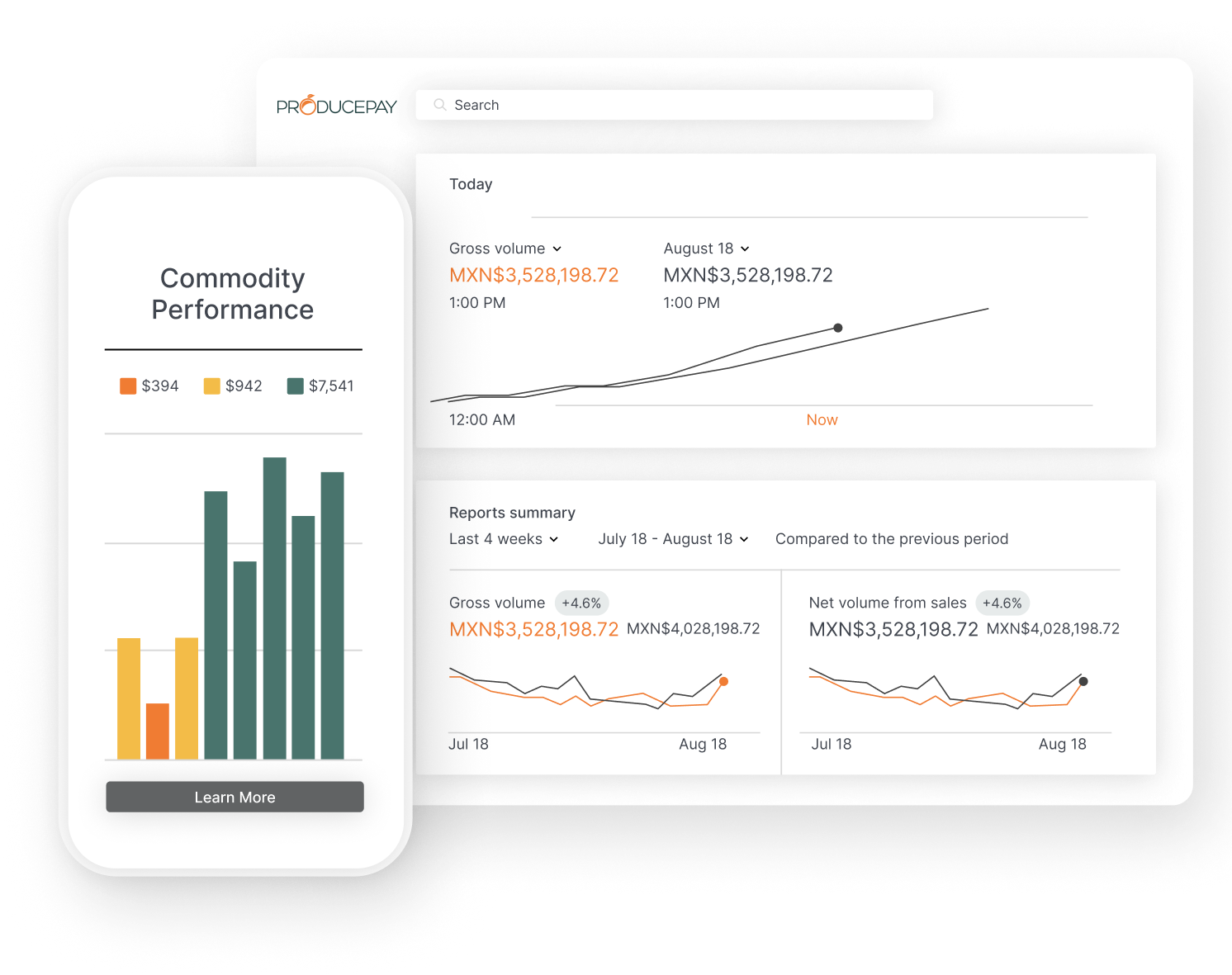

Put capital to work.

Our financial solutions are designed to help our customers find financial durability in the most volatile industry in the world.

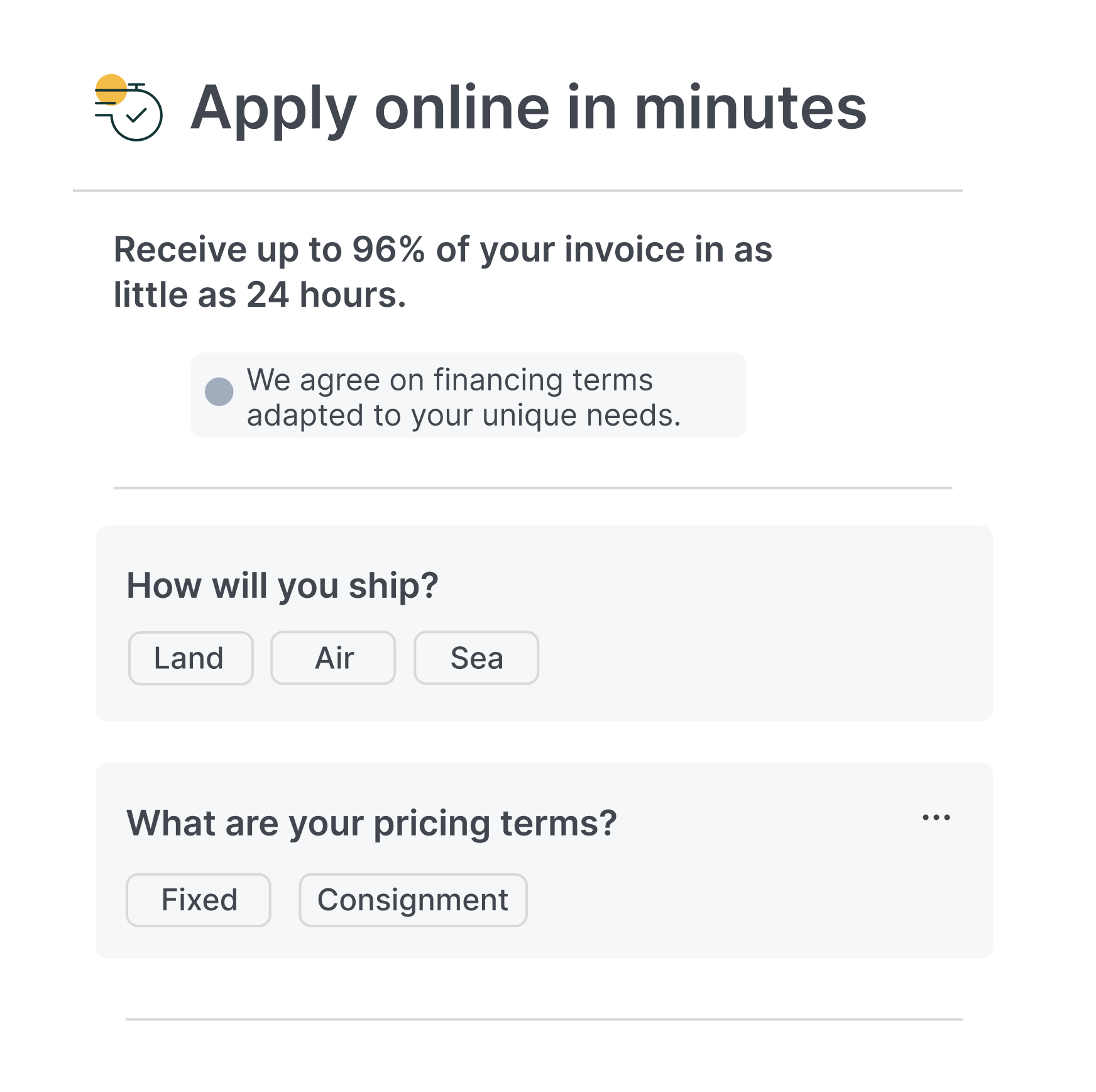

With Quick-Pay

Get faster payments on invoices with flexible terms to drive expansion.

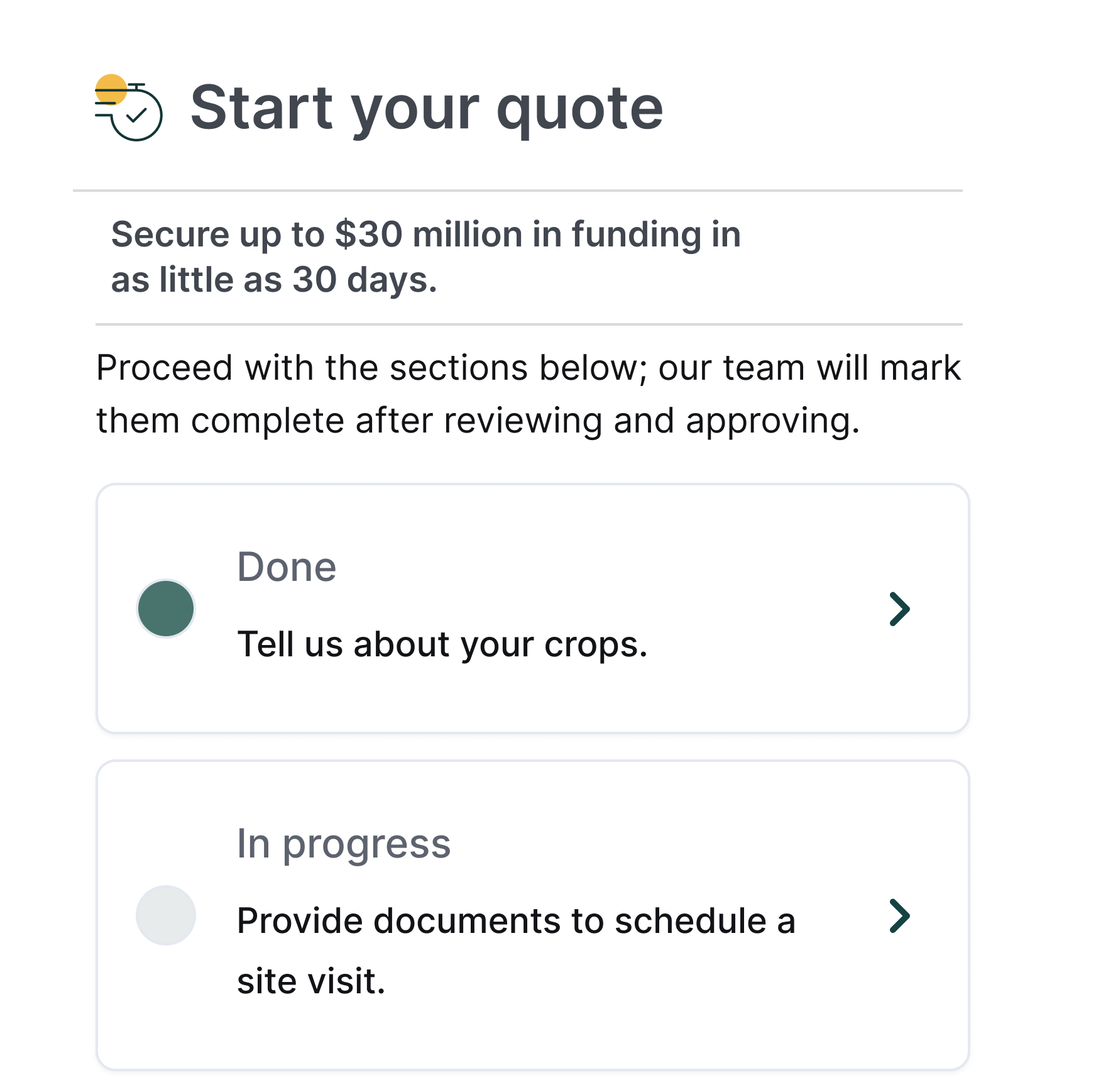

With Pre-Season

Get working capital to invest in growing your business on your own terms.

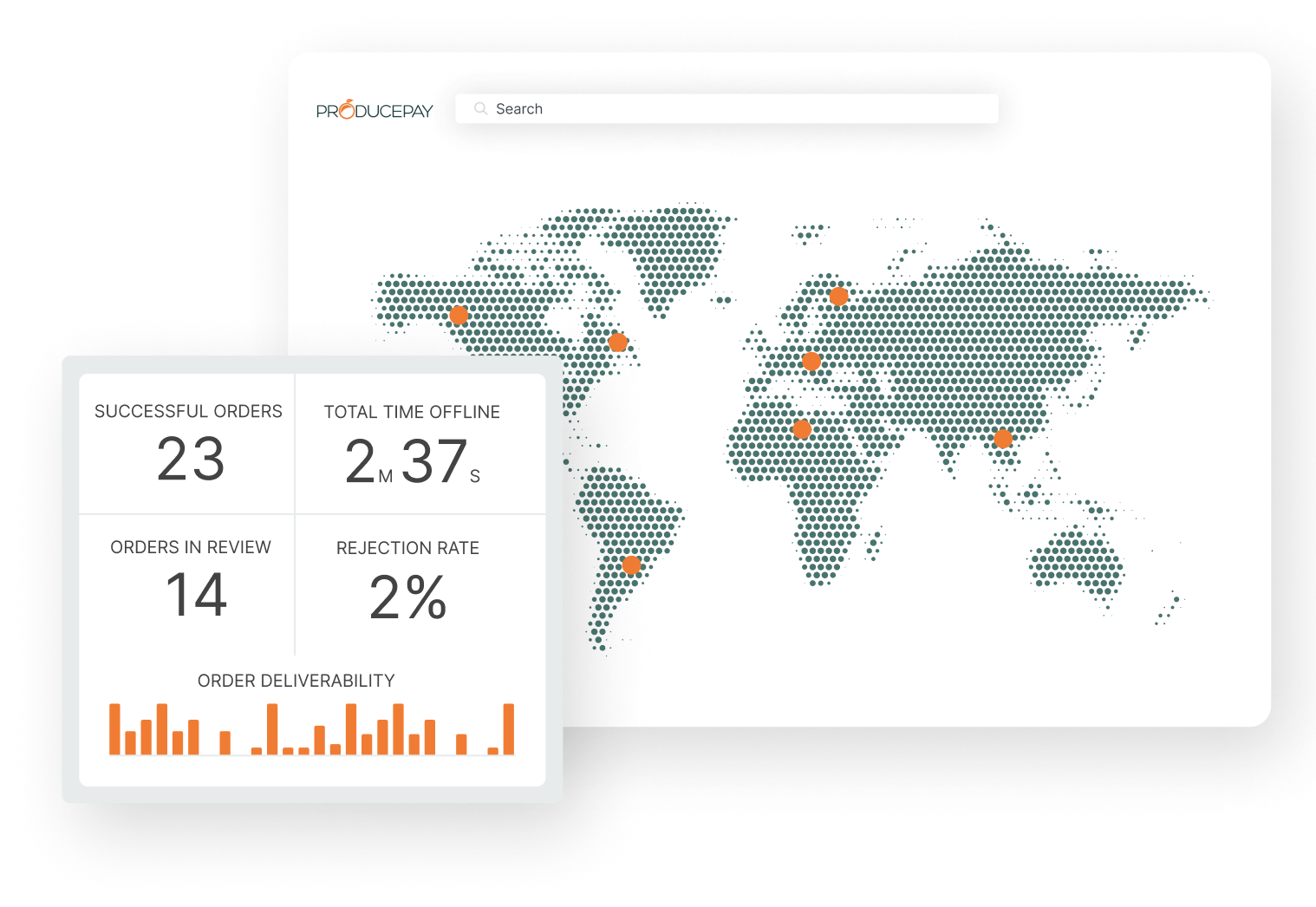

Trade with confidence.

Our trading experts facilitate high-quality trades through our global network of verified buyers and sellers.